In the first of a series of articles on financial and management accounting and business acumen, Richard Arnott and Jeff Lockhart take us through their essential guide to the budgeting basics

Oh no! It’s annual budget time

What is the most stressful time of the year work wise for you, your executives and your colleagues?

For those of you involved in the annual budgeting process many would put this as Number 1 on their list. It is, for many organisations, a time of extreme pressure, when there is a single focus to the apparent exclusion of everything else, tempers are on edge and late nights become the norm.

It’s probably no surprise to learn that budgets have never been particularly happy events in most organisations: for the finance team, it usually means a lot of extra work in collating data from all over the business, whilst for the operations and project team it means talking about finance instead of getting on with the day job or project.

Many employees develop negative feelings about the budgeting process because their compensation and, in certain cases, their jobs, may be dependent on meeting certain budgeting goals. Budgets always seem to carry negative vibes.

But budgets are important. They allow the leadership of the organisation to understand how the business is likely to perform in the future and what resources it will require to achieve success.

What is budgeting?

Budgeting is simply a process that allows businesses to plan and to achieve multiple goals in a single process. It is a plan for the future, expressed in financial and quantitative terms.

As individuals many of us have a plan, however vague, for a career that will bring in income and, undoubtedly, a dream of what that income might buy. We may also “budget” our weekly or monthly spend based on our predicted income. How much to spend on utilities, how much to spend on food, how much to save or invest?

Because it is relatively straight forward, very few of us will commit this to a spreadsheet and even fewer will plan out their full year ahead or beyond. We can generally do this in our heads or may just occasionally sit down and analyse what we are spending our money on, promise to stop doing it and then revert to norm within a few weeks.

For organisations, whether they are for profit, not for profit, mutual or otherwise they basically go through the same thought process: “Where is our money coming from, how much are we going to be spending and what is the difference?” Given the complexity, however, they will use tools such as dedicated budgeting applications and/or spreadsheets and the amount of data gathered is much more significant.

The Five Basic Principles of Budgeting

Principle 1

A budget is a plan to achieve agreed goals by a targeted date.

Principle 2

Garbage in = garbage out. A budget or plan needs time and effort dedicated to ensuring that the data being gathered to feed the budget process is as accurate as possible.

Principle 3

Sharing of information across functional areas is paramount for the budgeting process to deliver a quality outcome. Organisations that budget in silos will always struggle.

Principle 4

Budgets are predictions of the future based on the best information we have available at the time, both historic and about the future. Budgets are never accurate and tend to be continually re-forecasted.

Principle 5

Budgets must be monitored and controlled. It is pointless to develop a budget and then never check where you are against the budget.

Is budgeting worth the effort?

It can be argued that one of the most non-value-added activities within financial management is budgeting. Budgeting is about the future and, unfortunately, the future is hard to predict. In addition, senior management don’t always communicate clearly with people who prepare budgets. Because of poor communication, budgeting can quite quickly become an exercise in futility.

Why do most organisations persist with budgeting?

You may be surprised to learn that not all organisations budget (we will explore that in a later article), but most organisations still put themselves through this “painful” process and there are some valid arguments as to why.

Budgeting compels planning

By formalising the agreed objectives of the organisation through a budget preparation system, an organisation can ensure that its plans are achievable. It will be able to decide what resources are required to produce the desired outputs and make sure that they will be available at the right time.

The budget communicates and co-ordinates

Because a budget will be agreed by an organisation, all the relevant personnel will be working towards the same ends. During the budget setting process, any anticipated problems should be resolved, and any areas of potential confusion clarified. All the organisation’s departments should be in a position to play their part in achieving the overall goals. This objective of all parts of the organisation working towards the same ends is sometimes referred to as “goal congruence”.

The budget can be used to establish top-down control

For organisations where control of activities is deemed to be a high priority, the budget can be used as the primary tool to ensure conformity to agreed plans. Once the budget is agreed it can effectively become the authority to follow a particular course of action or spend a certain amount of money.

Public sector organisations, with their necessary emphasis on strict accountability, will tend to take this approach, as will some commercial organisations that choose not to delegate too much authority.

Budgeting enables empowerment

When asking for training, for example, have you ever heard the phrase, “Sorry, we do not have the budget for that this year/at the moment”?

Basically, this means that either the budget has been spent already or no budget was allocated to training in the first place. Usually, the former.

Had the budget been approved and had it not already been spent and your executive said “go ahead, we have the budget” it would mean that the training spend limit had not been reached, but more importantly your executive was pre-authorised to spend that money. No secondary permission is required.

The budget can be used to monitor and control

An important reason for producing a budget is that management is able to monitor the actual results against the budget. This is so that action can be taken to change the budget if it becomes unachievable.

The reality of “monitoring and controlling” is the daily, weekly, monthly or quarterly reviews of performance against plan. Reports are produced, variances identified, meetings held, and actions agreed as appropriate. It is critical to success.

The budget can be used to motivate

A budget can be one part of the organisation’s multiple techniques for motivating managers and other staff to achieve the organisation’s objectives.

The extent to which this happens will depend upon how the budget is agreed and set, and whether it is perceived as fair and achievable.

The budget may also be linked to rewards where short-term targets are met or exceeded.

As well as having long-term plans, it is essential to have short-term plans – it is only as the short-term plans are realised that the long-term plans can become reality.

The budgeting process

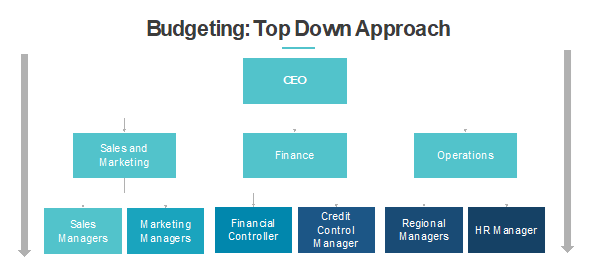

Whilst there is no single budgeting method which prevails in large organisations, the starting point for budget creation can either be at a strategic summary level (top-down budgeting) or from a detailed operational level (bottom-up or zero-based budgeting).

Top-down budgeting

Top-down budgeting is the easiest, quickest and simplest method to follow. In simple terms those at the top determine what the budgets are for the coming period and this is cascaded down through the organisation as an instruction.

Each process has its advantages and disadvantages which organisations need to consider when deciding which process to follow.

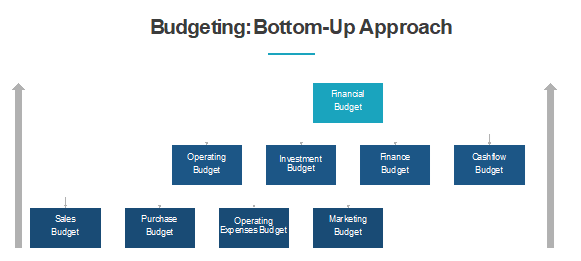

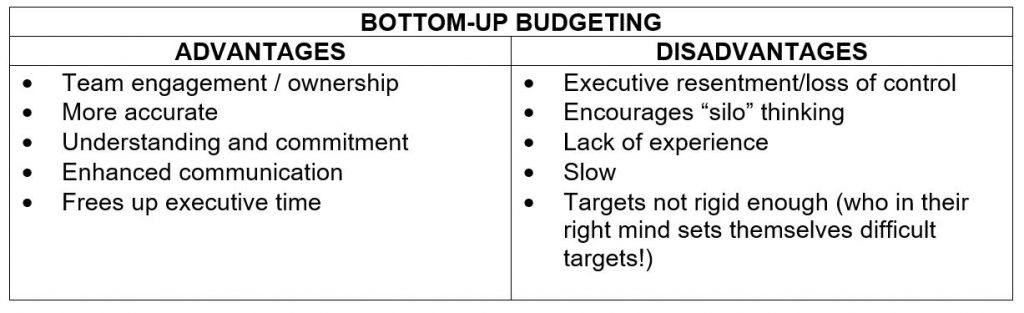

Bottom-up Budgeting

Bottom-up budgeting is a more detailed and time-consuming process adopted by organisations that believe in empowerment. Budgets are built from the ground floor and cascaded up through the organisation. Each functional area is in effect telling the senior leadership what they believe they are capable of doing in the next budgetary period.

Again, there are advantages and disadvantages of this approach

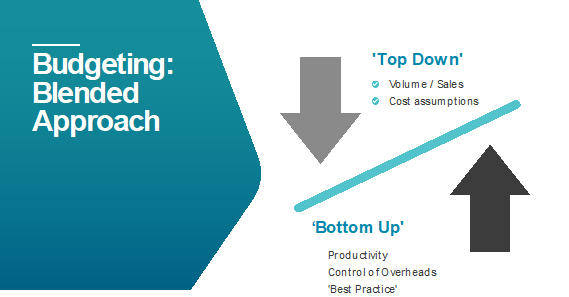

In practice most organisations use a combination of techniques, sometimes known as a ‘counter-current’ or “blended” process which looks to maximise the benefits of the top-down and bottom-up approaches.

How can the Executive Assistant help?

We already mentioned how stressful this time of the year can be for senior and middle management. This is where you can come to the fore by fighting off the distractions and creating the time that the team need. You already know how to do this of course.

But also volunteer to help, whether it be managing and coordinating the multitude of spreadsheets, coordinating meetings, chasing for team deliverables or even building and controlling the budget project plan so that everyone knows what is expected of them throughout the process. Ask your executive if you can get involved, sit by their side at update meetings and contribute. The more you sit in, the more you will learn.