Organisations need to meet the requirements of both their current and future customers and investors, explains Jeff Lockhart

The UK recently hosted the 26th UN Climate Change Conference of the Parties (COP26). The objective was to bring global leaders together to accelerate action towards the goals of the Paris Agreement and the UN Framework Convention on Climate Change. In attendance were US President Joe Biden, UK Prime Minister Boris Johnson, Canadian Prime Minister Justin Trudeau, and the Prime Ministers of Israel, Australia, Turkey, France, Italy, Colombia, Sweden, and Switzerland – to name but a few!

Global public interest in the event was considerable, particularly amongst younger demographics, but not everyone was impressed. “This is no longer a climate conference,” the Fridays for Future founder Greta Thunberg warned from the protest stage. “This is now a Global North greenwash festival; a two-week long celebration of business as usual and ‘blah, blah, blah’.”

Why Is This Important?

The message coming out of COP26 to consumers is that they can influence climate change by checking the environmental credentials of any organisation. What Greta Thunberg refers to as “greenwashing” might have been sufficient to tick the box in the past, but consumers are becoming increasingly savvy about examining the depth of any green policies.

Organisations need to ask themselves if they are meeting the requirements of their customers and investors in terms of their “environmental credentials.” And, more importantly perhaps, do they meet the requirements of the next generation of those key stakeholders?

We have seen an increase in the number of global companies committing to net zero; now companies need to translate pledges into real business transformation. This is key for both long-term business success and to address the climate crisis at the unprecedented scope and scale required.

Introducing Environmental, Social & Governance (ESG)

According to the Cambridge Dictionary, environmental, social and (corporate) governance (ESG) is a way of judging a company by things other than its financial performance – for example, its policies relating to the environment and how happy its employees are.

Investors – and, most notably, younger investors – have shown increased interest in putting their money where their values are. As a result, brokerage and mutual fund companies have started offering exchange traded funds (ETFs) and other products that follow ESG criteria.

The argument goes that to protect a business in the view of its investors – and future investors – a business must establish a strong ESG profile.

Some see it as corporate social responsibility – and there are similarities, but it’s much more than that. CSR 2.0, if you like!

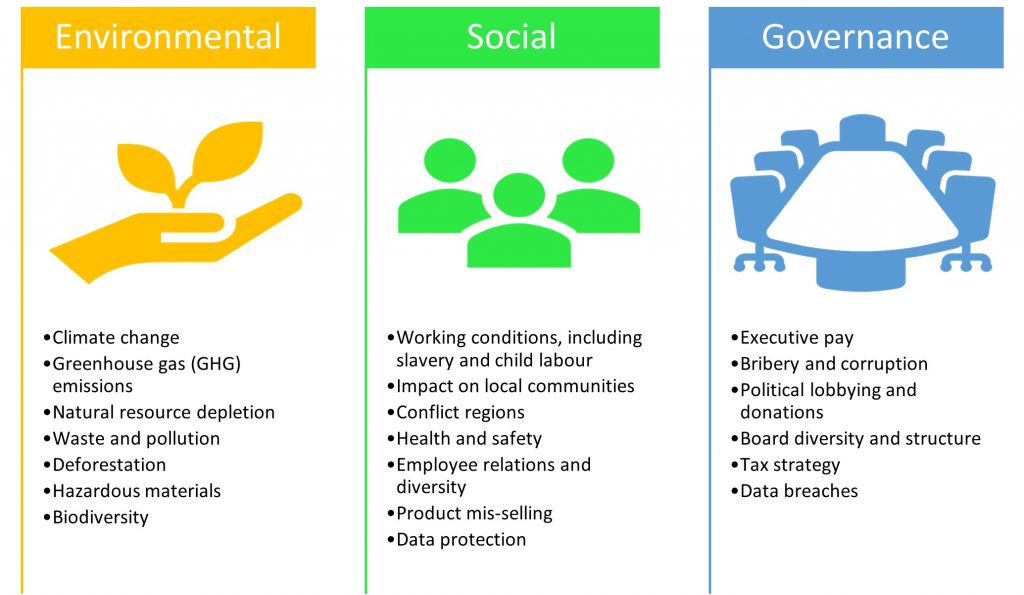

The ESG Criteria

The ESG criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how the company manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

While many ESG criteria are subjective (such as evaluations of “diversity” or “inclusion”), moves are occurring on several fronts that are designed to provide more objective, credible ratings of a company’s performance in terms of ESG policies and actions.

In the past, a company’s standing in terms of ESG has often depended less on substantive practices and more on how good the company’s public relations department is.

Environmental criteria

Environmental criteria may include a company’s energy use, waste, pollution, natural resource conservation, and treatment of animals. The criteria can also be used in evaluating any environmental risks a company might face and how the company is managing those risks.

For example, there might be issues related to its ownership of contaminated land, its disposal of hazardous waste, its management of toxic emissions, or its compliance with government environmental regulations.

Social criteria

Social criteria refers to the company’s business relationships. Does it work with suppliers that hold the same values as it claims to hold? Does the company donate a percentage of its profits to the local community or encourage employees to perform volunteer work there? Do the company’s working conditions show high regard for its employees’ health and safety? Are other stakeholders’ interests considered?

Governance

When it comes to governance, investors may want to know that a company uses accurate and transparent accounting methods and that stockholders are allowed to vote on important issues.

They may also want assurances that companies avoid conflicts of interest in their choice of board members, do not use political contributions to obtain unduly favourable treatment and, of course, do not engage in illegal practices.

Accounting giants KPMG have identified five ESG “megatrends” they believe are set to shape the business landscape, and that businesses need to recognise as they consider their future strategies.

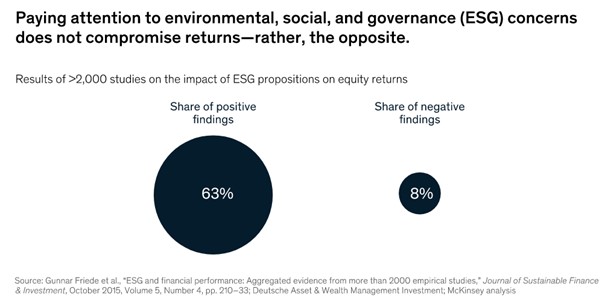

Further, a paper by consulting firm McKinsey & Co reported that “The overwhelming weight of accumulated research finds that companies that pay attention to environmental, social, and governance concerns do not experience a drag on value creation – in fact, quite the opposite.”

“A strong ESG proposition correlates with higher equity returns from both a tilt and momentum perspective. Better performance in ESG also corresponds with a reduction in downside risk, as evidenced, among other ways, by lower loan and credit default swap spreads and higher credit ratings.”

Why Does a Strong ESG Proposition Make Financial Sense?

Many say that ESG links to cash flow in five key areas:

- Helps high-level growth

- Reduces waste – and cost

- Minimises – or eliminates – regulatory or legal intervention

- Increases employee well-being – and productivity

- Optimises investment and capital expenditure

Although the focus has increased, none of this is new. Fifty years ago, acclaimed economist Milton Friedman wrote, “It may well be in the long-run interest of a corporation to devote resources to providing amenities to [the] community or to improving its government. That may make it easier to attract desirable employees, it may reduce the wage bill… or have some other worthwhile effects.”

Whatever your view, it seems that the push for businesses to address these ESG issues will continue to grow – driven by investors and shareholders, governments and policymakers, customers and suppliers, employees and citizens – just about all of our stakeholders.

There is a greater awareness, too, not just of the risks that need to be managed globally, but of the role that business has played in these. It follows that there will be opportunities as well, based on the scale of the transformation facing society.

Organisations are awakening to the need to reappraise their operations, not only to avoid potential regulatory repercussions, but to identify opportunities and, through these, realise significant new sources of value creation.

One thing is sure: ESG is here and it will be coming to your organisation soon!